Giving

Planned Giving

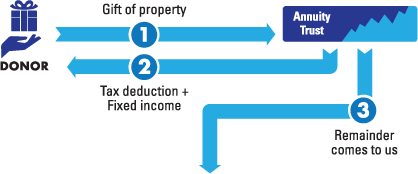

Charitable Remainder Annuity Trust

How It Works

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $100,000.

- The trust makes fixed annual payments to you or to beneficiaries you name.

- When the trust terminates, the remainder passes to Saint Viator High School to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up front capital gains tax on appreciated assets you donate.

- Use the trust to meet needs that are tied to a specific time frame, such as college tuition payments.

Next

- Frequently asked questions on Charitable Remainder Annuity Trusts.

- Related Gift: Charitable Remainder Unitrust.

- Contact us so we can assist you through every step.

Saint Viator High School

Located in Arlington Heights, IL, Saint Viator High School is a private, co-ed, Catholic school for grades 9-12. Students benefit from a challenging academic program, fine and performing arts, competitive athletics, and a wide selection of extracurricular activities.